Sell Your Lottery Payments

Get a $500 advance within 24 hours

when selling your annuity payments rights.*

Lottery Lump Sum PaymentsSo you have won the lottery, congratulations! Whether you won a substantial amount or a more modest sum, you now have a decision to make about how you will collect your earnings. In this article, we will define what a lottery lump sum is when compared with an annuity, as well as the pros and cons of each, and how you can go about collecting your lump sum payment.

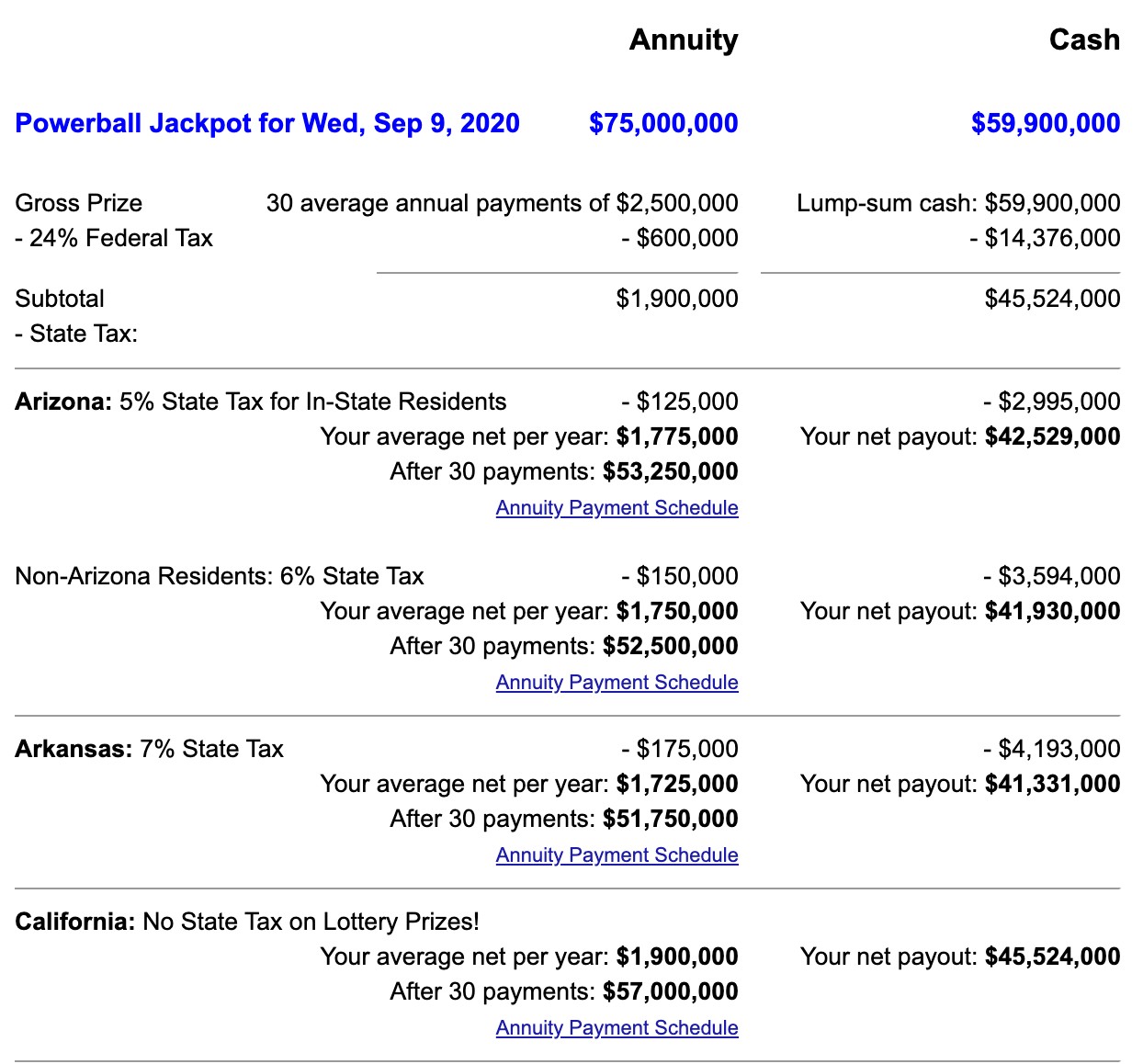

What Is a Lottery Lump Sum?A lottery lump sum is when a lottery winner receives their full amount of lottery winnings all at once, rather than receiving scheduled payments over a period of time, which would be the case with an annuity payment plan. Pros and Cons of a Lump Sum vs Annuity After Winning the LotteryA lump sum can have significant benefits or downfalls depending on your lifestyle, financial needs, and future financial goals, however, so can annuity. That is why it is so important to review the positives and negatives of going with a lump sum vs annuity payment for your lottery earnings before finalizing your decision. Here are a few things to consider as mentioned by Forbes.com: Money SpendingAfter winning the lottery, those who go with a lump sum payment might be tempted to spend more money than they should on material items, thus reducing their earnings significantly, even leading to financial trouble as a result. However, a lump sum payment does make it easy for recipients to purchase necessities such as a new house or car if they need it. An annuity forces lottery winners to continue life much as they did before, with enough money to live comfortably. However, should financial troubles arise, or an opportunity for a major purchase such as a house or car become a necessity, annuity recipients will not be able to change their payment plan or withdraw a set amount from their total earnings to pay for those amenities upfront. TaxationTaxation is another area where the benefits of lump sum payments and annuity payments differ. Those who decide they want to go with a lump sum payment for their lottery earnings should expect a decrease in earnings due to income tax. If a lottery winner earns hundreds of millions of dollars and they go with the lump sum payment option, then that significant amount of money is considered income, which is therefore taxable by the government. What this means is that they are now considered working citizens in the highest tax bracket, so the government will take a little over 30% of their earnings in income taxes for that first year. For example, if a lottery winner gets $100 million dollars and goes with a lump sum, they will actually only receive about $70 million of it after taxes. USAMega.com provides a Powerball Jackpot chart with estimates for gross winnings and net cash, by state, for the current Powerball jackpot. In contrast, lottery winners who go with an annuity payment plan will not have their total earnings reduced by government taxation all at once like with a lump-sum payment, because the amount they receive each month does not place them in the highest tax bracket in terms of income. This allows them the potential to actually earn more over a period of time due to interest rates and a lack of income tax on their entire earnings. However, there is no guarantee of this, especially if there is an economic downturn. ValueAnother factor where lump sum payments and annuity payments differ is the value they bring to recipients. Both of these create benefits and setbacks depending on a recipient’s intentions for their earnings. For example, going with a lump sum payment for your lottery earnings is beneficial if you want your earnings to go to your spouse, children, or grandchildren in your will. This is because a lump sum payment secures those funds for them later on. Once you get your lump sum payment and taxation is applied, that money is yours so it can go where you want it to, even after you die. However, depending on how old you are when you win the lottery and how much money you win, a lump sum payment might not be a sustainable option for you to live off of, so there might be little left for your heirs to receive. In contrast, annuity payments offer a consistent series of payments that could increase in value over time, hence increasing your monthly income. This might be a more beneficial option for those looking to live off of their lottery winnings for the rest of their life. However, once you die, there is no guarantee of these payments going to your spouse or immediate heirs, so if you want them to benefit, you might be better off going with a lump sum payment. MegaMillions.com points visitors to a resource to find Certified Public Accountants for financial advice.

How Does the Lottery Payout Work for Lump Sum Payments?According to thelotter.com, once you win the lottery, you need to follow the instructions as listed by your state’s lottery system. Most likely, you will either need to request a mail form or go to the lottery office in person with your winning ticket, valid I.D., and financial information such as your social security number and bank account information. Here, you will be able to select your preferred payment option. If you decide to go with a lump sum payment, you might have to wait a few weeks for it to be processed and added into your bank account. It is important to note that if your lottery winnings are significantly large (i.e., millions of dollars), you should go to your state’s lottery office in person to make sure you do not lose your ticket, and so that you can meet with a lottery representative to work through the process of claiming such a large amount of money. Sell Your Lottery AnnuityOnce you have decided on a lump sum payment or annuity payment plan, you can now take additional measures to get the most out of your winnings. Contact a Paymaster representative today if you chose to receive annuity payments but now desire a lump sum payment. |